Welcome to Dwyer Lawyers

At Dwyer Lawyers, we seek to provide the best quality legal advice by understanding our clients' individual, family and business needs.

By working closely with our clients and giving them the dedicated personal attention that only a small firm can give, Dwyer Lawyers helps them achieve their personal and family goals.

Dwyer Lawyers also work with our clients’ financial advisers to provide particular specialised advice where and when required. We are used to working with financial planners and accountants.

Our Legal Team

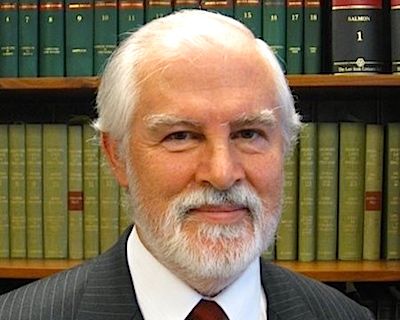

The Principal of Dwyer Lawyers, Dr Terence Dwyer is a highly experienced and qualified lawyer in the firm’s areas of practice.

Dr Dwyer has had wide experience in tax and superannuation advising in the Commonwealth Treasury and Prime Minister’s Department. He has subsequently advised Australian and international clients on tax and business planning and has advised on the drafting of business-friendly legislation both in Australia and overseas.

Ms Deborah Dwyer gained her LLB from the Australian National University and has added an LLM in comparative law. Her interests include advising on CGT and business succession issues, international taxation issues, tax deductible status for non-profit organisations, and has written on various tax and business subjects as well as drafting an amendments to the managed investments regime within the Corporations Act.

Areas of Practice

Dwyer Lawyers practise in all areas related to clients’ needs to grow and protect their family’s wealth and provide for their well-being.

At Dwyer Lawyers we can help you plan for the growth and protection of your hard-earned wealth, for both your benefit and your family’s. This is not an easy task. Laws and taxes are complex and seem ever-changing. We view business and investment structuring and estate planning as inter-related.

At Dwyer Lawyers we can provide advice to assist you in this area. How efficiently you and your spouse or partner manage your income and assets now determines your standard of living both now and in your retirement and will affect the estate you or your partner and your family will have available for support. The business and investment decisions you take now will determine how your estate serves you while you are alive and how it will look after your family.

Because Dwyer Lawyers have worked over the years on a range of policy and legislative changes, including drafting, Dwyer Lawyers brings to the practice of estate, superannuation, tax and business planning a range of experience and expertise which helps inform their advice. Often, there is more than one way to achieve your ultimate wealth planning objectives and it helps, in looking at alternative legal strategies, to take into account the trend of policy and legislation (which in turn may influence the way the Courts handle previous precedents).

Wills & Estates

For Dwyer Lawyers it’s the value of advice which counts. While we all like to save money, one can be “penny wise and pound foolish”.

A simple will can be done for relatively little money but if you have complex business and assets issues, will it ensure that there are no tax traps or testator's family provision traps left for you or your spouse? What are the CGT implications? Can anyone challenge the will? Will it ensure assets are protected? Are you getting the most benefit from the CGT small business tax concessions? Dwyer Lawyers can help protect your interests - don't assume this won't be your problem. Someone else's failure to plan will be.

Where clients only require a simple will and do not wish to consider estate planning we are happy to assist.

Services we provide are:

• estate planning

• wills and probate

• family provision planning

• charitable bequests

• powers of attorney

• trusts

Business and Asset Protection

Dwyer Lawyers also provide a range of services in relation to growing and protecting wealth including:

• partnerships

• companies

• business and commercial law

• business set-ups and structuring

• business succession planning including family or management buyouts

• business buy-sell agreements

• employee share plans

• employee or management buyouts including family buyouts

• associations and charities

• tax planning and advice

• capital gains tax

• Division 7A dividends

• international tax

• double tax treaties and reliefs

• stamp duty

• fringe benefits tax

• GST

• migration tax planning inwards or outwards

• international investment planning

• asset protection

• life insurance trusts

• superannuation including self-managed superannuation

House Calls and Inter-State Visits

It used to be common for family solicitors to attend upon clients to obtain their instructions e.g. to discuss will preparation or to witness signing. We believe in old-fashioned personal service. Once we have a client relationship established with you, we are happy, where mutually convenient, to attend upon clients at home or at their offices or to visit them inter-state.